SBI,India’s Biggest Bank, Torn Between BlackRock

SBI,India’s Biggest Bank, Torn Between BlackRock. State Bank of India needs to fund coal activities to meet the Indian chief’s push to zap more homes, yet it needs to back sustainable ventures to assuage financial backers like BlackRock Inc. Until further notice it’s doing a touch of both.

“Financial backers’ interests are vital to us, we contemplate them,” the moneylender’s head of corporate banking and worldwide business sectors, Ashwani Bhatia, said in a meeting. “In any case, we additionally have responsibilities to the country. There are so many coal mineshafts being created in India since we need them to deliver steel, aluminum, power.”

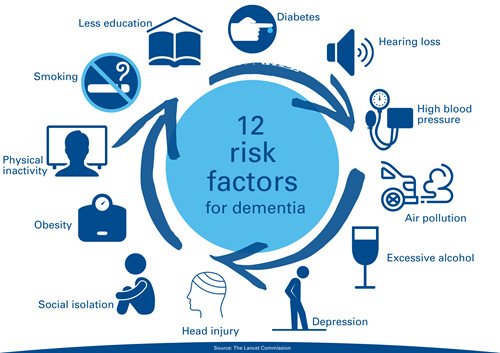

The recorded state-claimed loan specialist has an extreme difficult exercise on its monetary help for coal-terminated force plants, which are a significant supporter of air contamination. Worldwide financial backers are progressively limiting help to organizations engaged with separating or devouring coal, yet almost 70% of India’s power comes from coal plants and interest for power is set to ascend as the economy recuperates from the blows of the pandemic.

BlackRock and Norway’s Storebrand ASA, the two of which hold under 1% in the bank as indicated by Bloomberg information, brought up their criticisms over the previous year. Amundi SA stripped its possessions of the loan specialist’s green bonds as a result of the bank’s connections to a questionable coal project in northern Australia.

State Bank of India hasn’t concluded whether to help money the Carmichael dig for Adani Enterprises Ltd, whose fundamental investor is extremely rich person Gautam Adani, following mounting pressure from environment activists and financial backers, Bloomberg detailed in April.

Financing for worldwide energy is at a tipping point. Green bonds and advances from the worldwide financial area so far this year surpassed the worth of fossil financing interestingly since the securing of the Paris Agreement at the finish of 2015.

In India, the shift away from coal will require some serious energy. A huge number of residents stayed without power a long time after PM Modi’s arranged cutoff time to charge each home spent two years prior. The climate service recently additionally postponed hostile to contamination rules for power plants that utilization the fuel.

The shift to sun oriented from warm is going on step by step in India as organizations advance toward cleaner fuel-based innovation, Bhatia said, adding that the bank is quick to support organizations that make electric vehicles. The bank additionally charges 20 premise guides less on credits toward people getting to buy electric vehicles, he said.

The bank has been boosting the portion of advances to the spotless energy area and it endorsed multiple times more advances to sunlight based ventures in the monetary year that finished in March than to the general warm area, the 59-year-old financier said. That is on the grounds that there was not really any interest for new advances from petroleum product makers a year ago, he said, adding that most long haul credits to warm activities are existing responsibilities.

The moneylender’s advances to the influence area remained at ₹ 1.86 lakh crore ($25.6 billion) or 7.3 percent of the complete toward the finish of March with ₹ 31,920 crore of advances to environmentally friendly power, as per the bank’s most recent expert show. The organization doesn’t offer a reprieve down of its loaning to coal or different fragments inside the force area.

“Being the biggest bank in the country we are additionally the biggest funder of sun oriented drives of enormous organizations,” he said. “The shift from warm to sun based has begun occurring in a huge manner.”