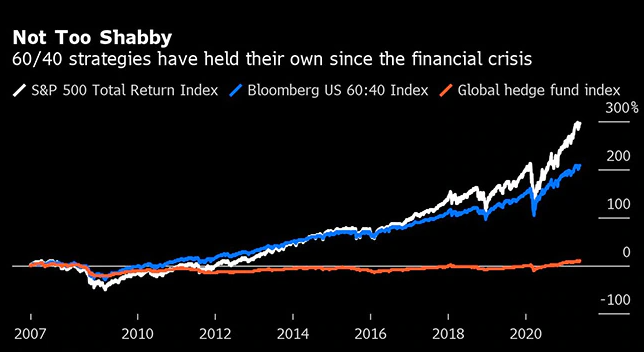

Is 60/40 Rule Good Investment Option?

Is 60/40 Rule Good Investment Option however, and now the worries are about something beyond the low gets back from government bonds.

The key standard supporting the 60/40 methodology is that the more modest fixed-pay portion should pad misfortunes when stocks droop. However during an episode of market unpredictability in March, the two values and securities auctions off simultaneously.

In the event that both resource classes were to begin moving couple consistently, that would raise doubt about the general purpose of holding lower-returning bonds as a support.

So how can a retail financial backers respond?

Try not to freeze

While the concerns are largely substantial, they don’t mean a 60/40 resource split has abruptly become monetary self destruction short-term.

“60/40 is definitely not an awful spot to begin,” said Christine Benz, head of individual accounting at Morningstar. “The thought it’s dead is a misrepresentation venture firms now and then toss out there in light of the fact that they are hawking different procedures, in many cases more confounded, as a rule all the more expensive.”

On the off chance that you need to go the DIY course, be sure about your goals.

There’s a colossal contrast in a fitting assignment for somebody hoping to resign in 30 years, versus somebody searching for returns five years out.

In any event, during when 60/40s were stylish, monetary counselors wouldn’t have proposed somebody near the very edge of retirement apportion most of their cash to unpredictable values. Similarly, a 20-year-old would have been advised to designate more to development resources.

Furthermore, recollect, adjusted portfolios are never intended to convey the most extreme conceivable degree of return. You’re presumably not going to get the kind of market-destroying returns Cathie Wood’s development centered ARK reserves scored up in 2020.

Maybe, the thought is to safeguard capital, give expansion and insurance in awful occasions, just as an adequate return.

Be practical about those profits

In our current reality where 85% of created market government securities are yielding under 1%, likely gets back from a customary blend have plunged. While Vanguard information show a 60/40 blend returned a normal 9.1 percent a year from 1926 to 2020, JP Morgan Asset Management as of late assessed it will return simply 3.7 percent over the course of the following decade.

Security yields have begun to rise once more, which means it’s a preferable hopping off point over it was for new financial backers, yet with loan fees at record lows across cutting edge economies, significant yields on safe resources are something of the past.

That is genuine in any event, for the stars. Speculative stock investments have progressively moved into an ever increasing number of fascinating items – think everything from complex subsidiary items to music back indexes – yet returns have been inconsistent and accompanied high expenses.

“There aren’t a ton of mispriced modest resources out there,” said Simon Doyle, head of fixed pay and multi-resource methodologies at Schroders Australia.

Try not to accept the appropriate response is simply more tech stocks

As bond returns have plunged, numerous retail financial backers have increased their distribution in stocks, attracted by the potential for higher development. While over the drawn out values have truly beated bonds, that is not generally the situation – following the tech bust in 2000, value files basically went sideways for 10 years.

Also, transient unpredictability is regularly more limit in values than in fixed pay. That implies you need control to abstain from committing the exemplary error of selling in a frenzy, yet in addition be practical about your time skyline. Holding pat may be fine for somebody in their 20s or 30s who has numerous years to brave any droops, yet undeniably more risky for somebody hoping to resign in a more limited time span.